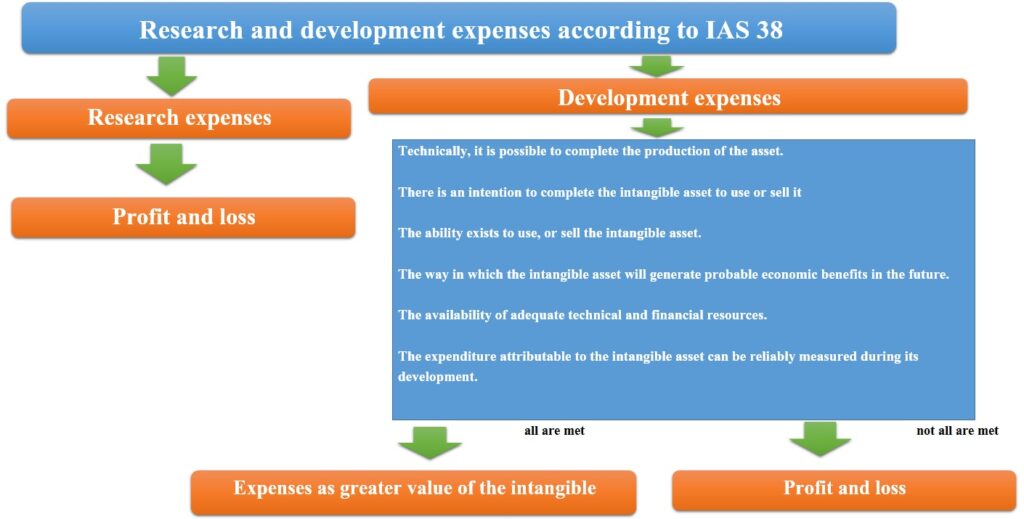

Research and development expenses related to intangible assets, are regulated in paragraph 52 of IAS 38.

This paragraph is established that all research expenses associated with the generation of an intangible, must be recognized in results.

As for development expenses must be capitalized as a higher value of the asset if all the requirements set out in paragraph 57 of IAS 38 are met.

The requirements to be able to recognize development expenses as an asset are as follows:

Technically, it is possible to complete the production of the intangible asset to be made available, for use, or sale.

There is an intention to complete the intangible asset to use, or sell it.

The ability exists to use, or sell the intangible asset.

There is evidence to show how the intangible asset, will generate probable economic benefits in the future.

The technical, financial, or other resources are available to complete the development and to use, or sell the intangible asset.

And finally, the disbursement attributable to the intangible asset, can be reliably measured during its development.

Let’s see a practical example.

Example of research and development expenses according to IAS 38

If you want to get this exercise in Excel, you can make a request to the following email : info@ifrsmeaning.com

In year 1, a company begins the development of a chemical formula to increase people’s life expectancy.

This year, research expenses were incurred for 500,000, and development expenses for 450,000.

As of December 31 of year 1, the entity estimates that the product’s demand will be 250,000 units per year once completed.

However, to date, the company doesn’t know if it will be able to count on the necessary units to respond to demand since its production plant is under construction.

And on the other hand, to date, the entity doesn’t have 100% of the project’s financial viability.

As of December 31 of year 2, the entity has all the financial viability of the project, and in addition, the progress of the production plant is 90%.

This year, research and development expenses equal 70,000 and 2,000,000 respectively.

Based on the above information, what is the entity’s cost to recognize the intangible?

Many might think that the intangible cost should be 2,450,000, which corresponds to the development expenses in years 1 and 2.

However, this is not the case since, as we said before, an entity must comply with all the requirements established in paragraph 57 of IAS 38, to capitalize all disbursements related to the intangible.

As we can analyze, the exercise determine that at the end of year 1, the entity was uncertain about the financial viability of the project, and on the other hand, the company didn’t know if it could complete production.

Many preparers of financial statements mistake reclassifying prior period expenses, and capitalizing them in the current year, arguing that all the requirements of paragraph 57 are met.

However, this is an error, because paragraph 71 of IAS 38, set out the following:

Expenditure on an intangible item that, was initially recognised as an expense shall not be recognised as part of the cost of an intangible asset at a later date.

In conclusion, the cost of the intangible is 2,000,000, and the research expenses are 500,000 for year 1, and 70,000 for year 2.

What to do with fully depreciated assets that an entity continues to use

Fully depreciated assets can be a headache for a company when an external audit revises the financial statements. Many auditors

Differences between module 18 intangibles SMEs and IAS 38

Within section 18 IFRS for SMEs, updated in 2015 and IAS 38 exist ten differences that we will analyze below:

5 key examples to understand the IAS 38 intangible assets

Our comprehensive guide provides the nuances of IAS 38 intangible assets through practical examples, ranging from the separate acquisitions of