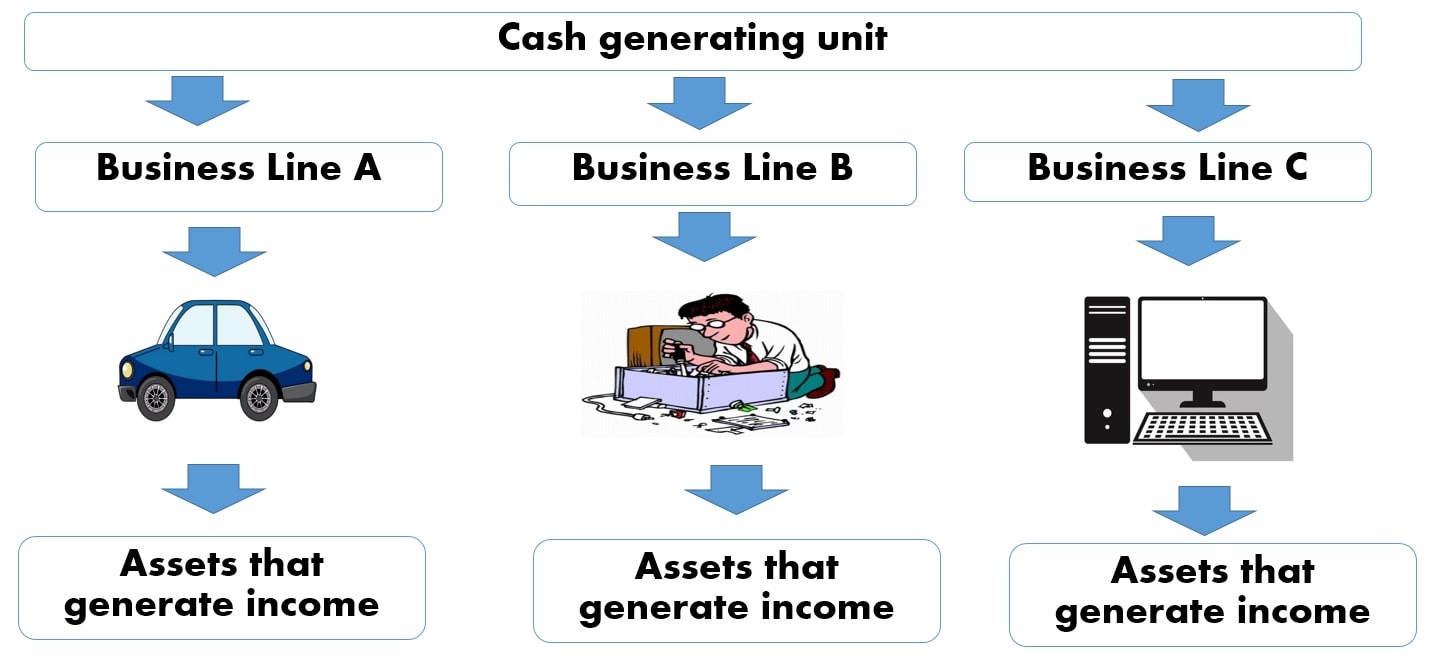

A cash generating unit is an identifiable asset group that provides a company with cash inflows.

These cash flows are independent of those generated by other types of assets.

Let’s see an example to understand this concept easily:

In our IFRS course we make an exhaustive analysis of IFRS standards with examples and practical cases, we also include the use of artificial intelligence applied to international financial reporting standards, if you want to be an expert in IFRS we invite you to review the following page [click here]

An entity has three business lines named A, B, and C.

The economic activity of line A is the sale of vehicles, and on the other hand, lines B and C are committed to the assembly and sale of computers.

Each business line has its assets that help it generate financial benefits.

However, as you can see, business line B, and business line C, have interdependence in the development of their activity.

For this reason, these two business lines individually do not meet the definition of a cash generating unit.

Otherwise, in the case of the business line related to the sale of vehicles, the cash flows generated largely independent of the other cash flows generated by the other assets owned by the company.

We want to introduce you to our IFRS course, which has a new methodology based on answers and questions using videos and training tests.

Recoverable amount cash generating unit

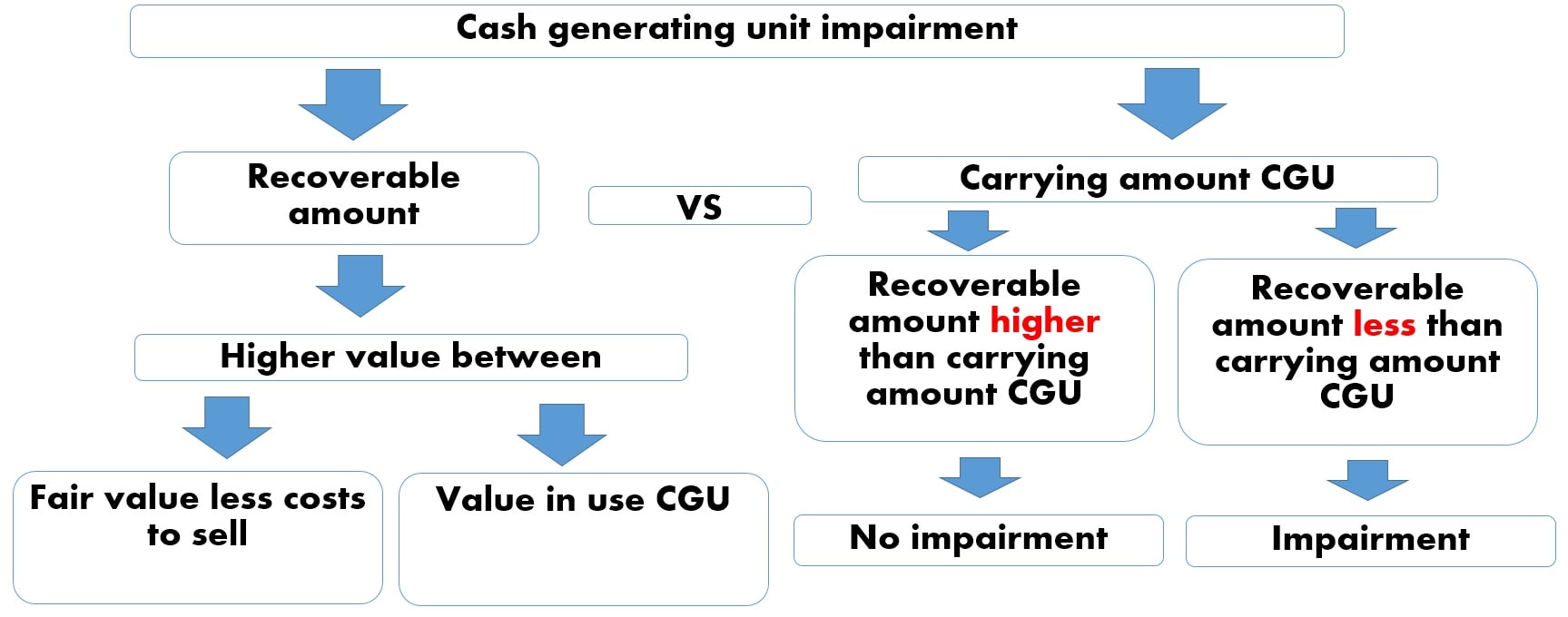

Understanding a cash generating unit meaning, is useful in determining the impairment of a group of assets.

Taking the example we are analyzing as a reference, suppose that the entity needs to know if part of the assets that make up business line 1 is impaired.

However, the entity’s management has the difficulty of not establishing the recoverable amount of that group of assets; for this reason, it decides to calculate the recoverable amount of the cash generating unit.

As we see in the diagram, an entity must determine if the recoverable amount of a cash generating unit is below its carrying amount.

If so, an entity must recognize an impairment loss for the difference calculated.

An entity that intends to determine the recoverable amount, must take the higher of the fair value less costs to sell the assets to make up the line of business, and their value in use.

The value in use, is the present value of the future cash flows that a series of assets can generate.

Let’s see a practical example, to easily understand this topic.

Example of cash generating unit impairment

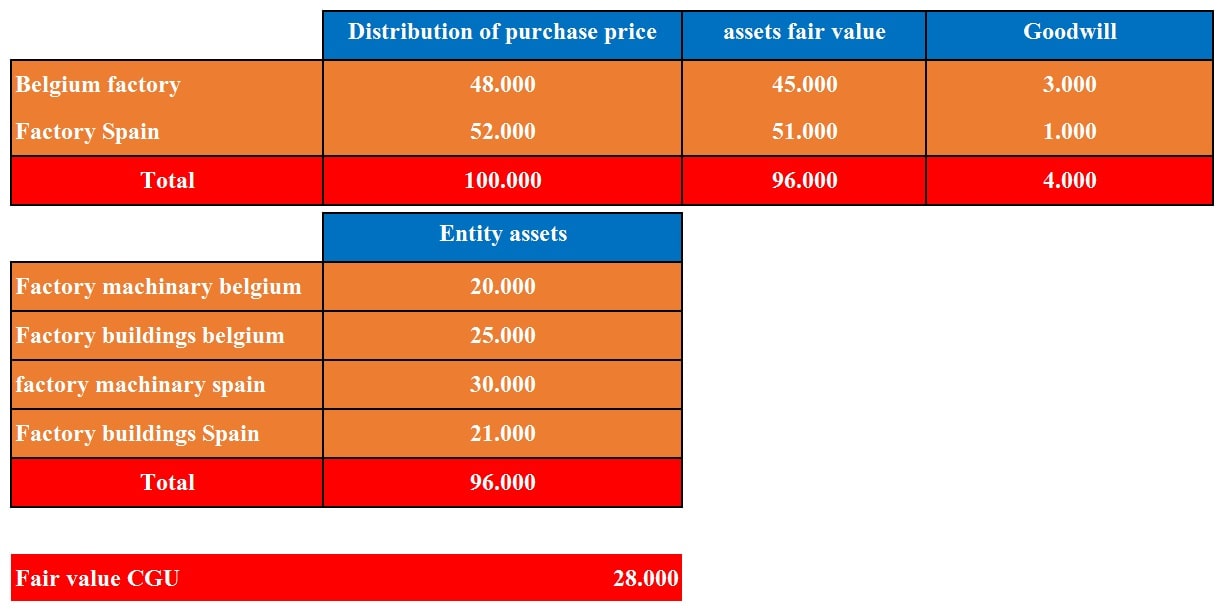

In January of year 1, as part of its expansion strategy, company A, dedicated to high-end marketing vehicles, acquired 100% of the shares of entity B, for 100,000.

Entity B, is dedicated to the production and assembly of wholesale vehicles.

This company has two factories in Belgium, and Spain.

The fair value of the identifiable assets of factory 1, is equal to 45,000, and the identifiable assets of factory 2 are 51,000.

In this way, as we can see, the goodwill generated equals 4,000.

This goodwill is the result of paying a higher value for the assets of entity B.

On the other hand, each factory has a group of assets.

The assets carrying amount of factory located in Belgium, comprises machinery with a balance of 20,000, and buildings by 25,000.

And as for the factory located in Spain, the balance of these assets amounts to 30,000 and 21,000.

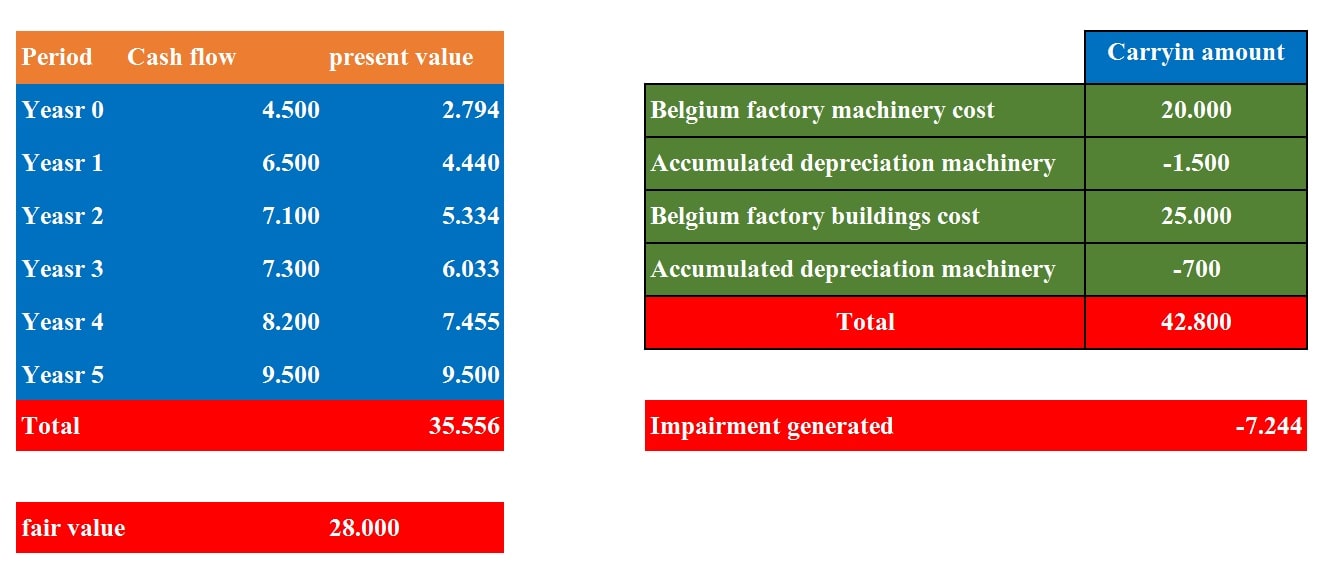

During year 1, due to an economic crisis in Belgium, the management of the factory located in this country, considered that it was very likely that this cash generating unit could present impairment.

For this, the company calculates the value in use of this unit using a discount rate of 10%.

It is essential to say, that IAS 36 recommends the use of weighted average cost of capital, to determine the rate which to calculate the value in use of a cash generating unit.

Besides, the cash generating unit fair value at the end of the reporting period equals 28,000.

The present value of the cash flows as of December of year one is shown below.

As we can see, the value in use, results in a present value of 35,556, and the fair value equals 28,000 at the end of the period.

Therefore, the recoverable amount of the cash generating unit, is equal to 35,556.

On the other hand, the assets carrying amount of the factory located in the country of Belgium as of December of year 1 is as follows:

Thus, at the end of the period, the assets group carrying amount, is equal to 42,800, while the recoverable amount is equal to 35,556.

That is, the entity must recognize an impairment loss of 7,244

Now, to establish how we should distribute this impairment in the cash generating unit, it is necessary to review paragraph 104 of IAS 36.

This paragraph determines that the impairment loss of a cash generating unit will be distributed in the following order:

First, to reduce the carrying amount of any goodwill allocated to the cash generating unit.

And then, to the other assets of the group of units pro rata on the basis of the carrying amount of each asset in the group of units.

As we can analyze, we must recognize an impairment loss of 7,244.

However, it must consider that this loss must be attributed in the first instance to the goodwill.

As we saw earlier, the goodwill generated in the business unit located in Belgium country is 3,000.

In other words, the impairment must be attributed to the goodwill balance and the remaining balance of 4,244 to the other assets of the unit.

As we see in the following table, was reduced to zero the goodwill balance due to the impairment loss.

On the hand, the impairment assigned to machinery is 1,835, and to buildings equals 2,410.

(18.500 /(18.500 + 24.300) x (7.244 -3.000 ) = 1.835

(24.300 /(18.500 + 24.300) x (7.244 -3.000 ) = 2.410

News related to cash generating unit

Impairment of receivables

To analyze the impairment of accounts receivable, it’s necessary to keep in mind a concept known as expected credit losses; this concept incorporated in

5 Key Advantages of Understanding Depreciation Methods in accounting

Explore various depreciation methods as outlined in IAS 16. Understand the nuances of straight-line, diminishing balance, and units of production