In this article, we will see different examples and practical cases related to IAS 8.

This standard shows 3 different elements.

Changes in accounting policies.

Changes in accounting estimates.

Errors.

Practical example 1 - changes in accounting policies.

In January of year 1, a company dedicated to selling computers had an initial balance of 100 computers at 700 dollars.

In March, the entity acquired 150 units at 750 dollars.

In June of this year, 170 computers were sold for $1,500 per unit.

And at the end of this year, 50 units were sold, also at 1,500.

On the other hand, in February of year 2, the entity made the last sale of 20 units at 1,600.

In this example, the entity uses the FIFO method to recognize the inventory sales cost.

The inventory movement for year 1 is shown below:

The inventory sales cost of year 1 amounts to 160,000, which is equivalent to the sum of the sales made in June for 122,500 (70,000 + 52,500) and the sales made in December for 37,500.

In the FIFO method, an entity must use the units that were entered first.

In this case, 170 units were sold in June.

This sale must be divided into two parts, on the one hand, 100 units at a unit cost of 700 and after this, 70 units at a unit cost of 750, and finally, in December 50 units at the cost of 750.

The ending inventory for year 1 is 22,500.

In February of year 2, a sale of 20 units is made at a unit cost of 750; this results in a cost of sale for year 2 of 15,000 and an ending inventory of 7,500.

In December of year 2, the entity decided to change its accounting policy and set out that it would measure its inventories from now on using the weighted average formula.

This change occurs because the company’s management considers that this method allows showing more reasonably the changes in the cost of sales of the inventories.

The movement of inventories using the weighted average formula for years 1 and 2 is shown below.

As you can be see, for year 1, the ending inventory using the FIFO formula is 22,500, and with the weighted average formula, it is 21,900.

For year 2, the ending inventory is 7,500 using the FIFO formula and 7,300 using the weighted average formula.

Regarding the cost of sale, for year 1, it is 160,000, and for year 2 it is 15,000; using the FIFO formula.

Using the weighted average formula, the cost of sale for years 1 and 2 is 160,600 and 14,600, respectively.

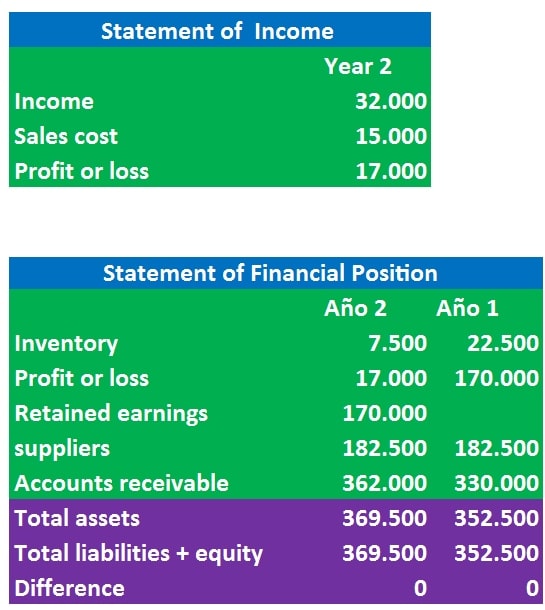

The financial statements before the change in accounting policy are as follows:

In our IFRS course we make an exhaustive analysis of IFRS 16 with examples and practical cases, we also include the use of artificial intelligence applied to international financial reporting standards, if you want to be an expert in IFRS we invite you to review the following page [click here]

Because it is a change in accounting policy, a retroactive application must be made.

That is, the entity shall adjust the opening balance of each affected component of equity for the earliest prior period presented.

And the other comparative amounts disclosed for each prior period presented as if the new accounting policy had always been applied.

The accounting entries in year 1 are as follows:

The accounting entries in year 2 are as follows:

It is important to say that in year 2, the entity must be recognized the changes in profit or loss because the financial statements have not been authorized.

The financial statements restated after the policy change are as follows:

Practical example 2 - changes in accounting policies limitations to retrospective application

In year 1, an entity acquires 250 machines with useful lives of 20 years.

In year 12, the carrying amount of the property plant and equipment is 2,000,000.

At the end of this year, the entity changes its accounting policy because it considers that the depreciation by components better shows the company’s economic reality.

According to management’s judgment, it is not possible to determine the depreciation and calculate the effect of this change in previous periods.

For this reason, the company uses paragraphs 23 to 25 of IAS 8 and determines that, as it cannot reliably set out the effect in previous periods.

For this reason, it’s necessary to apply this policy change prospectively.

Information on property plant and equipment by components is shown below.

Component 1: 550,000, remaining life: 9 years

Component 2: 700,000, remaining life 7 years

Component 3: 600,000, remaining life 10 years

Component 4: 150,000, remaining life 5 years

In this way, the entity must calculate the depreciation in the current period of each component based on the remaining useful life and the carrying amount to date.

Practical example 3 - change in an accounting estimate:

In January of year 1, an entity buys a specialized machine for 700,000.

For the asset to function appropriately, it is necessary to make several modifications in the warehouse where the asset will operate.

The asset adaptation cost is 150,000.

In 10 years, the entity agrees to deliver the asset in the same conditions in which it was received and estimates that demolishing the adjustments and restoring the warehouse will cost 70,000.

After 10 years, the company estimates that it will sell the machine for 30,000.

The discount rate is 11%

At the end of year 6, due to new information, the entity considers that the necessary disbursements to restore the warehouse at the end of year 10 will no longer be 70,000, but 120,000

How should we recognize this change in estimate under the IAS 8.

The total cost of the asset in this example is as follows:

Acquisition price: 700,000

Directly attributable costs: 150,000

Dismantling costs: (1 + 11%) ^ – 10X70,000) = 24,653

Total assets: 244,643

The table of interest on the dismantling liability is shown below:

Change in accounting estimate

At the end of year 6, the carrying amount of property plant and equipment is as follows:

Historical cost: 244,643

Residual value: 30,000

Depreciable amount: 214,643

Accumulated depreciation: 128,759

Carrying amount: 115,884

The estimated liability for decommissioning at the end of year 6 is 46,111

The change in the value of the disbursements that the company must make at the end of the project is a change in an accounting estimate that will be recognized prospectively.

Changes in the measurement of a decommissioning liability are regulated in paragraph 5 of IFRIC 1, which establishes the following:

If the corresponding asset is measured using the cost model

Changes in the liability will be added to or deducted from the cost of the corresponding asset in the current period.

In this way, the present value of the liability must be recalculated to year 6.

PV= (1+11%) ^-4X120.000 = 79.048

The accounting record is as follows:

The adjustment of 32,937 is the difference in the liability at the end of year 6 by 46,111, and the new recalculated liability of 79,049, due to the change in the estimate of decommissioning costs.

In summary, the new liability is: 79,048

The new asset value is:

Historical cost: 244,643

Accumulated depreciation: 128,759

Adjustment for changes in liabilities: 32,937

Carrying amount: 148,821

The accounting entries for year 7 are as follows:

The depreciation expense was calculated as follows

Carrying amount: 148,821

Residual value: 30,000

Depreciable amount: 118,821

Remaining useful life: 4 years

Depreciation expense: 118,821 / 4 = 29,706

Practical example 4 - example of an error

An entity buys a building in year 1 for 15,000,000 with a useful life of 60 years.

At the end of year 4, the entity realizes that there was an error since the correct useful life of the asset is not 60 years but 80 from the date of acquisition.

The depreciation expense before and after the error for years 1 through 4 is shown below:

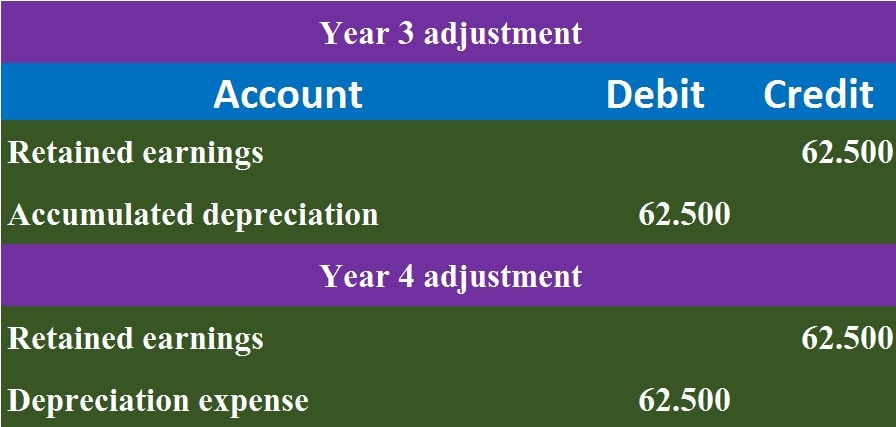

Under paragraph 42 of IAS 8, an entity shall correct material errors of prior periods, retrospectively, in the first financial statements formulated after the errors have been discovered.

An entity must re-expressing the comparative information for the previous period or periods in which the error originated or, if the error occurred before the oldest period for which the information is presented, re-expressing the initial balances of assets, liabilities, and equity for the said period.

The accounting entries are shown below:

Finally, it is important to say that if the error lacks relative importance or materiality, it will not be necessary to show the effect of the error correction.

Change in Accounting Estimate: Thorough Examination with Practical Scenarios

A Change in Accounting Estimate is an essential concept in accounting that involves the revision of estimated liabilities based on

What to do with fully depreciated assets that an entity continues to use

Fully depreciated assets can be a headache for a company when an external audit revises the financial statements. Many auditors

What is the difference between an accounting policy and an estimate

The difference between an accounting policy and an accounting estimate is that changes in estimates are recognized prospectively, while changes