Dive into the concept and significance of the ‘recoverable amount’ under IAS 36 in asset impairment evaluation.

Learn how it’s calculated and its relevance in effective business asset management.

Understanding the Importance of the Recoverable Amount

In the realm of business asset management, the ‘recoverable amount’ under IAS 36 stands as a key term that warrants understanding.

This concept incorporated in International Financial Reporting Standards (IFRS), specifically under IAS 36, is instrumental in determining asset impairment.

In our IFRS course we make an exhaustive analysis of IFRS standards with examples and practical cases, we also include the use of artificial intelligence applied to international financial reporting standards, if you want to be an expert in IFRS we invite you to review the following page [click here]

Recoverable Amount Formula

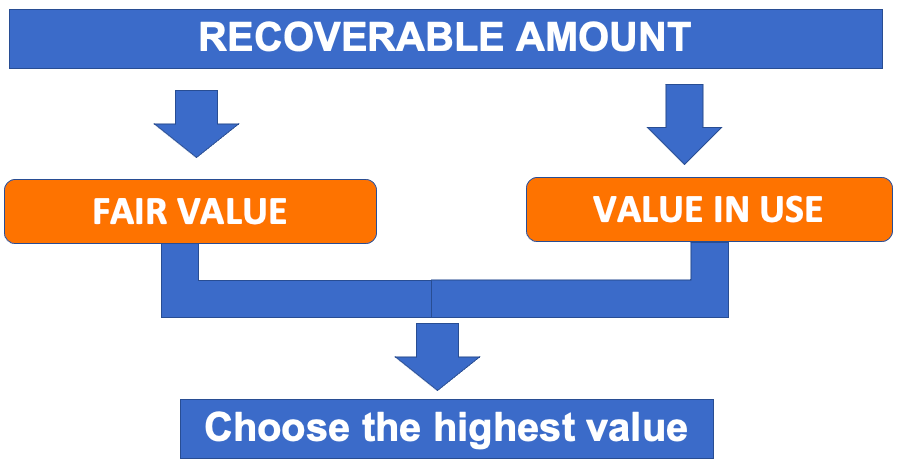

The recoverable amount can be defined as the highest value between the asset’s fair value less costs of disposal and its value in use.

This concept plays a crucial role in assessing whether an asset or cash-generating unit (CGU) is impaired, a scenario that arises when the recoverable amount falls below the asset’s carrying amount.

In such instances, an impairment loss equivalent to the resulting difference must be recognized.

Value in Use: A Key Component of the Recoverable Amount

A prime component of the recoverable amount is the ‘value in use’.

This refers to the estimated present value of cash flows that an asset is anticipated to generate over a specific period.

Let’s delve deeper into understanding this term.

Understanding Value in Use with an Example

Consider, for example, a company that specializes in manufacturing electric vehicles.

This company expects its cash flows to increase significantly over the next decade due to the transition from gasoline-powered vehicles to electric vehicles.

For determining the value in use, the present value of the cash flows these assets can potentially generate over time needs to be considered.

If the present value generated exceeds its fair value, this value will be considered the recoverable amount.

IAS 36: A Framework for Calculating Value in Use

IAS 36 provides a comprehensive framework to calculate the value in use of an asset.

It necessitates accounting for future cash flows, possible fluctuations in the amount or timing of cash flows, the time value of money (usually indicated by the current market risk-free interest rate), the price for bearing uncertainty, and other factors that market participants would consider when pricing future cash flows.

Why is the Recoverable Amount Relevant?

The relevance of the recoverable amount extends beyond its role in understanding asset impairment.

A thorough understanding of the recoverable amount can significantly improve asset management.

It allows the management to ascertain if the company’s assets are impaired and display signs of impairment.

In situations where the recoverable amount falls below the book value, recognizing an impairment loss for the generated difference becomes mandatory.

Recoverable amount example

A company dedicated to the production of computers has 2 lines of business.

On the one hand, the assembly line, and on the other hand, the design line.

The assembly business line has the following assets.

The carrying amount of this line at the end of the period follows.

In addition, the entity considers the fair value of the line of business at the end of the period to be 45,000.

On the other hand, the value in use of this business line is presented below.

The company considers a discount rate of 9%

As we can analyze, the value in use is greater than the fair value.

For this reason, this will be the value that we must take to determine if the business line is impaired.

Recoverable amount = Fair value versus value in use

Recoverable amount = 45,000 vs. 69,380

The next step is to compare the carrying amount of the line of business against its value in use.

Impairment = 69,390 – 92,000 = 22,620

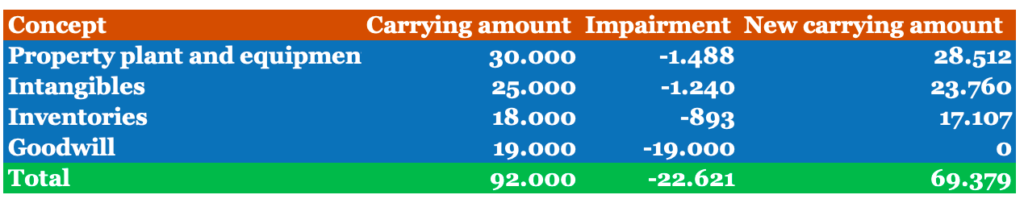

We must now allocate this impairment to the assets of the cash-generating unit.

As established by IAS 36, the impairment generated must be attributed in the first instance to the goodwill of the cash-generating unit, based on the following formula.

Remaining impairment = goodwill – impairment

Remaining impairment = 19,000 – 22,620 = 3,620

We must distribute the balance of 3,620 to the other assets of the business as follows.

calculations

Total carrying amount of the unit = 30,000 + 25,000 + 18,000 = 73,000

Property, plant and equipment: 30,000 / 73,000 = 41%

Intangibles: 25,000 / 73,000 = 34%

Inventories: 18,000 / 73,000 = 25%

Assigned Impairment

Property, plant and equipment: 3,620 x 41% = 1,488

Intangibles: 3,620 x 34% = 34% 1,240

Inventories: 3,629 x 25% = 893

If you want more information about the impairment and the recoverable amount of a cash-generating unit, I invite you to read the following post.