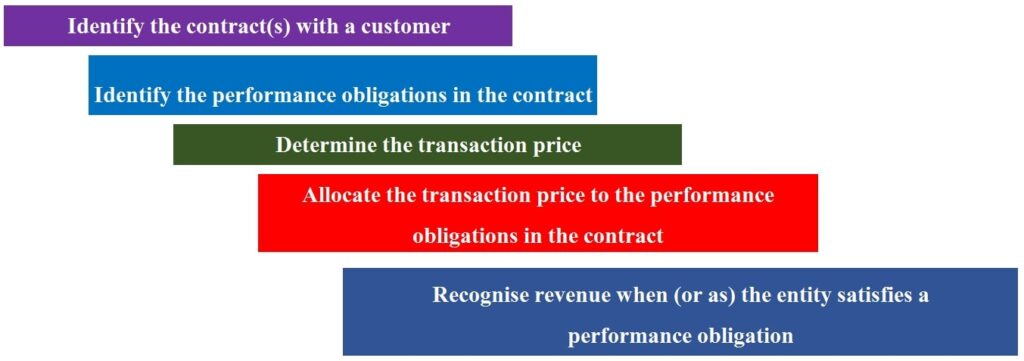

Revenue recognition in IFRS 15 is based on the 5-step application principle:

Identifying the contract

Identifying performance obligations

Determining the transaction price.

Allocating the transaction price to performance obligations.

Recognition of revenue from ordinary activities.

In our IFRS course we make an exhaustive analysis of IFRS standards with examples and practical cases, we also include the use of artificial intelligence applied to international financial reporting standards, if you want to be an expert in IFRS we invite you to review the following page [click here]

Identifying the contract

IFRS 15 replaces IAS 18.

IFRS 15 recognizes the revenue based on contracts.

Paragraph 9 of this standard establishes five requirements for a contract to meet the parameters to be within the scope of this standard.

The parties have approved the contract.

The entity can identify each party’s rights regarding the goods or services to be transferred.

The entity can identify the payment terms for the goods or services to be transferred.

The contract has commercial substance.

The entity will probably collect the consideration.

All the requirements previously mentioned must be met for a company to be able to recognize the revenue set out in the contract.

For example, a company signs a contract with a client to sell a building for 2,000,000.

The contract establishes that the client must give an initial deposit of 30%, and the entity will finance the remaining 70% for two years.

In addition to the above, the financing agreement is carried out without a real estate guarantee, which means that if the client defaults on payments, the entity can regain ownership of the building.

The contract was signed in January of year 1.

The client’s objective is to adapt the building and use it as an aesthetic clinic.

However, the building is located in a sector in which the customer’s demand is quite low, which could hinder the client’s economic stability and, therefore, your commitment to pay the loan.

And to the other hand, the client does not have financial backing from other investors.

Contract Analysis

As we said previously, the analysis must be carried out based on the requirements established in paragraph 9 of IFRS 15.

The parties have approved the contract: This fact is evidenced by the signing of the contract between the parties in January of year 1.

However, it is important to say that the standard does not require that the contract be agreed upon in writing; there are also oral contracts with the same legal force.

The entity can identify the rights concerning the goods and services traded: The contract determines that the company can recover the goods if the client defaults on payments.

The entity can identify the payment conditions: The client pays an initial deposit of 30%, and the remainder will be financed over two years.

The contract has commercial substance: The commercial basis is established when there is a certainty that there is or maybe a change in the cash flows of both parties.

This is evidenced by the fact that the company will increase its income from the sale of an asset, and on the other hand, the client will have to disburse a series of resources to acquire the building.

The entity will probably collect the consideration to which it is entitled: The company concludes that this requirement is not met because there is a high probability that the client will not be able to pay the consideration contemplated in the contract.

And on the other hand, the client does not have financial support from an investor.

As all the requirements of paragraph 9 of IFRS 15 are not met, the entity should review paragraphs 15 and 16 of this same standard.

Paragraph 15 specifies that when the requirements in paragraph 9 are not met, an entity shall recognize revenue when the two requirements shown below are met:

The entity has no remaining obligations to transfer goods or services to the customer, and all, or substantially all, of the consideration promised by the customer has been received by the entity and is non-refundable.

Or the contract has been terminated, and the consideration received from the customer is non-refundable.

The entity observes that none of the events described in paragraph 15 have occurred.

That is, the entity has not received all the consideration substantially, and the contract has not been terminated.

Consequently, under paragraph 16, the entity accounts for the non-refundable payment received for 30% of the total value of the building as a liability.

In this way, the entity continues to account for the initial deposit and any payment made after the debt as a deposit liability until it concludes that it meets the criteria in paragraph 9.

If it were the case that the client reached an agreement with a strategic partner to support them financially, the company would conclude that paragraph 9 is met and, therefore, all deposits delivered by the client would be recognized as income for ordinary activities.

Performance obligations Identification

The identification of the performance obligations corresponds to step 2 of this standard.

Inside this classification, you can find an additional element that explains how the satisfaction of these obligations is carried out.

This explanation is found in detail in the post that I show you for continuation:

Transaction price determination

The transaction price is the amount of consideration to which an entity is entitled in exchange for transferring the promised goods or services to a customer.

Five variables can influence the transaction price between the parties :

The variable consideration is the amount an entity expects to receive for the goods and services delivered.

This consideration may vary due to discounts, rebates, refunds, credits, price concessions, incentives, performance bonuses, or other similar elements.

Constraining estimates of variable consideration means that an entity will include in the transaction price all or part of the amount of the variable consideration estimated under paragraph 53 of IFRS 15.

The above considers that a significant reversal of income from ordinary activities is highly probable when the uncertainty about the variable consideration is subsequently resolved.

In other words, if, for example, an entity sells 2,000 products to a customer and there is a possibility that a large percentage of these products are returned due to some circumstance, revenue should not be recognized because there is no realistic expectation regarding recognition of revenue, even if the products have already been delivered to the customer.

Concerning the existence of a significant financing component in the contract, an entity will adjust the amount of the consideration for the effects of the value of money over time.

This means that if the entity allows the client the opportunity to pay for the products beyond the normal terms of payment, this financing will affect the price of the transaction established in the contract.

The fourth element that can affect the transaction price in a contract is when an entity can acquire goods and services in exchange for a consideration other than cash, such as the shares of a company, provided that this consideration is measured at fair value.

And finally, there is a concept called consideration paid to a customer.

This element is presented when an entity delivers a series of resources to a customer at the beginning of the contract as part of an agreement.

These resources will be recognized as a lower value of transaction price.

For example, an entity is dedicated to the sale of beer.

The contract establishes that the customer, at the beginning of the contract, received $15,000 from the company so that it could install a series of refrigerators to store the products.

These resources received by the customer represent a lower value in the beer-producing company’s transaction price.

Assigning the transaction price to the performance obligations in the contract

The objective of assigning the transaction price is for an entity to distribute this price to each performance obligation, that is, to each different good or service.

The distribution of this price is made based on three variables:

The fourth step to revenue recognition is to allocate the transaction price to performance obligations.

This allocation is based on the independent sale prices of the different goods and services established in the contract.

Remember that the independent sale price is the price for which an entity would sell a good or service separately to a customer.

In a contract, in the majority of cases, the independent sale price of a good or service is readily determinable.

However, there are cases where the independent sale prices of some products are not readily determinable.

When this occurs, it is necessary to use the procedures established in paragraph 79 of IFRS 15.

Each procedure it explained below.

The adjusted market assessment approach is the first procedure that an entity can use to determine the independent sales price.

This approach estimates the independent sales price concerning the market prices of those same goods or services.

The other method is the expected cost plus a margin approach; this method is based on determining the cost of the goods and services and adding a profit margin that the entity considers satisfies management’s expectations.

And finally, the residual approach, this method is based on the transaction price minus the sum of the observable independent sales prices of the other goods or services promised in the contract.

Recognition of revenue from ordinary activities

Finally, the fifth step established in IFRS 15 is revenue recognition.

This last step is the result of combining the four steps previously.

Exchange assets accounting recognition

Exchange assets : are the exchange of one or more non-monetary assets or a combination of monetary and non-monetary assets.

Title: Unraveling Asset Impairment: The Significance of Recoverable Amount under IAS 36

Dive into the concept and significance of the ‘recoverable amount’ under IAS 36 in asset impairment evaluation. Learn how it’s

Rebates and discounts IFRS 15 and IAS 2

This article refers to discounts for inventory sales regulated in IFRS 15 and discounts for inventory purchases under IAS 2.